Prices for oil, like those for many other commodities, are inherently volatile and volatility itself varies over time. In recent years, the oil market has been characterised by rising, and at times, rapidly fluctuating, price levels. In the last nine months alone, crude oil prices have fluctuated in a wide range from $75/bbl to $125/bbl. However, careful examination of historical patterns shows that the volatility observed during 2008-2009 is actually lower than the peak observed in 1990‑1991.

The concept of volatility is often confused simply with rising prices; however, volatility can equally result in prices that are significantly lower than historical average levels. Volatility is the term used in finance for the day-to-day, week-to-week, month-to-month or year-to-year variation in asset or commodity prices. It measures how much a price changes either versus its constant long-term level or long-term trend.

Some recent academic studies have based their claim of higher prevailing volatility on the observation of exceptionally high absolute day-to-day changes in WTI crude oil prices. This measure is at best misleading. Absolute price change does not give any information regarding the observed volatility in the market. It is important to note that volatility measures variability, or dispersion from a central tendency. In this respect, volatility does not measure the direction of price changes; rather it measures dispersion of prices from the mean. A ten-dollar increase in an environment where the average oil price is about $100/bbl does not imply higher volatility than a five-dollar increase when the average price is $30/bbl.

Some recent academic studies have based their claim of higher prevailing volatility on the observation of exceptionally high absolute day-to-day changes in WTI crude oil prices. This measure is at best misleading. Absolute price change does not give any information regarding the observed volatility in the market. It is important to note that volatility measures variability, or dispersion from a central tendency. In this respect, volatility does not measure the direction of price changes; rather it measures dispersion of prices from the mean. A ten-dollar increase in an environment where the average oil price is about $100/bbl does not imply higher volatility than a five-dollar increase when the average price is $30/bbl.

While the average unit price of WTI crude oil was $38/bbl between 1990 and 2011, prices have veered from $147/bbl in mid-2008 to $35/bbl in December 2008 and back to $110/bbl in mid-April 2011. Although the average annualised daily returns between 1990 and 2011 on crude oil were about 7.7%, they registered a negative 8% between 2005 and 2011. A test for normality indicates that daily returns are not normally distributed. Both negative and positive shocks are responsible for the non-normality of daily returns.

In order to explore the nature of volatility inherent in WTI crude futures prices, daily time price series for the nearby contract (closest to delivery) have been constructed. Before maturity (the expiration date), most participants in the paper market either close out positions or roll them over from the nearby contract to the next-to-nearby contract. The problem of data seasonality due to rolling has been mitigated here by focussing on the nearby contract and excluding price changes caused by delivery mechanisms. Daily returns for each contract were computed using settlement prices set daily by the exchange at the market close. In particular, daily returns can be defined as rt=pt-pt-1, where pt is the natural logarithm of the settlement price on day t. Both pt and pt-1 refer to the next-to-nearby contract for days on which a switch from the nearby to first deferred contract occurs.

As explained in the March 2011 Oil Market Report, there are various ways to measure volatility. In this report, four different historical volatility measures for WTI crude oil prices are presented. Historical volatility looks at past behaviour of price movements and measures the variation in the price. One such measure is the standard deviation. Standard deviation (σ) is computed from a set of historical data as

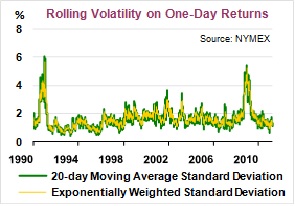

where R is the return calculated as the natural log of daily changes in the price of the underlying asset and µ is the mean return during the look-back period. However, the sample mean µ is seen by some analysts as a very inaccurate estimate of the true mean, especially for small samples; taking deviations around zero instead of sample mean typically increases volatility forecast accuracy. Twenty-day moving average and exponentially weighted moving average standard deviation show similar qualitative volatility estimation. In January 2009, annualised volatility peaked at 87%, a ten‑year high, followed by a rapid decline to relatively low levels. On the other hand, volatility reached its historical peak level (96% annually) in January 1991.

where R is the return calculated as the natural log of daily changes in the price of the underlying asset and µ is the mean return during the look-back period. However, the sample mean µ is seen by some analysts as a very inaccurate estimate of the true mean, especially for small samples; taking deviations around zero instead of sample mean typically increases volatility forecast accuracy. Twenty-day moving average and exponentially weighted moving average standard deviation show similar qualitative volatility estimation. In January 2009, annualised volatility peaked at 87%, a ten‑year high, followed by a rapid decline to relatively low levels. On the other hand, volatility reached its historical peak level (96% annually) in January 1991.

Apart from standard deviation-based volatility, model-free absolute return was calculated as a proxy for daily volatility as well as range-based volatility estimation. The high-low volatility is calculated as follows:

where Ht and Lt denote, respectively, the highest and lowest prices on day t. As expected, both range-based and absolute return proxies for daily volatility displayed very noisy volatility estimators. However, both estimators revealed the fact that the increased price volatility observed during 2008-2009 was temporary rather than permanent.

The empirical observation that volatility is not constant over time and that it has memory has led to more sophisticated time series models, known as generalised autoregressive conditional heteroskedasticy (GARCH) models. These models capture the persistence of volatility, time-varying mean as well as the non-constant nature of volatility. Since the conditional variance at time t is known at time t-1 by construction, it provides a one-step ahead conditional variance forecast.

The following GARCH model was estimated to produce conditional volatility for daily crude oil return rt:

where ht is the conditional variance and σt=√ht is the conditional standard deviation, which measures volatility. GARCH estimation produces a measure of conditional volatility which is less noisy than the absolute return approach but it requires that the model define the true data generating process, zt be Gaussian, and that the time series be long enough for maximum likelihood estimation. GARCH conditional volatility estimation also suggests that the increase in volatility observed during 2008-2009 was a temporary phenomenon and that volatility in the oil market remains consistent with historical averages.

*IEA Medium Term Oil and Gas Markets-June 2011

Wow! This can be one of the most beneficial blogs we have ever come across on the subject. Basically magnificent article! I am also an expert in this topic so I can understand your effort.

ReplyDeleteCrude Oil Trading Report

This comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete

ReplyDeleteI've been waiting for this blog. I must say your blog is the most useful post of all the traders. If anyone wants to trade in the stock market tips and MCX tips

A nice article on crude oil.

ReplyDelete